7 days ago

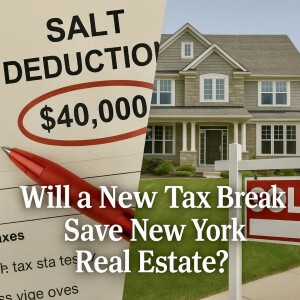

Will a New Tax Break Save New York Real Estate?

Let’s talk about something spicy—no, not Thai chilis. I’m talking taxes. (Trust me, it’s more interesting than it sounds.)

This week’s episode breaks down one of the most buzzworthy changes buried in the latest federal budget: the new $40,000 SALT cap.

For years, homeowners in high-cost, high-tax states—think New York, New Jersey, California—were stung by the $10,000 cap on state and local tax deductions. Now? That cap has jumped to $40,000, and it could shake things up in some of the most expensive housing markets in the country.

Here’s what we unpack:

- 🧂 What the SALT cap even is (and why it matters)

- 💸 How it affects upper-middle-income and affluent buyers

- 🏡 Which counties are most likely to benefit (spoiler: hello Westchester)

- 📉 Why this won’t move the national housing market—but could matter a lot locally

- 🧠 What real estate agents, developers, and retirees need to be thinking about

Whether you’re buying, selling, or just wondering what the heck “SALT deduction” means, this is your quick, clear, and honest breakdown of how policy might change the real estate game (or just slightly tilt the board).

If you ever want to buy or sell a property anywhere in the world, our team would be honored to help get you to your next destination.

Until next time, stay curious, stay hungry, and as always… stay ALL IN!

Amit Bhuta

COMPASS

ALL IN Miami Group

Licensed Real Estate Agent

📱 (305) 439-3031 Mobile

📧 amit.bhuta@compass.com

No comments yet. Be the first to say something!